Aug 19--We need to stop Western EU tech exports to Russia

Part 1- thread by Kamil Galeev; Part 2- Italy's love for Russian business; Part 3- Yale University School of Management companies still operating in Russia list

Western EU tech aiding Russia’s war against Ukraine

On Kremlin File and EuroFile I’ve talked with analysts and experts in the field of energy and finance, and our discussions were focused on what can be done to limit or stop Russia’s war against Ukraine.

Dr Benjamin Schmitt was right to point out something that most of us haven’t talked about yet: Western Europe is still selling technology and machine tools to Russia, and that means we are still aiding Russia’s war of aggression against Ukraine. Both the US and Europe must be on the same page on this.

This post is divided into three parts. In part one, I have included a thread composed by Kamil Galeev about Western EU tech and why we need to stop selling this to Russia. In part two, you’ll read about an Italian company that is still operating in Russia as well as information pertaining to business dealings between Italian and Russian businesses. If you aren’t interested in part two, you can skip down to part three to view the Yale University School of Management website, and check to see if a company from your country is still operating in Russia.

Part 1: Kamil Galeev

Kamil Galeev is an independent researcher and journalist at the Wilson Center. He is currently pursuing his MLitt in Early Modern History at the University of St Andrews as a Chevening Scholar.

In July 2019 he graduated from the Yenching Academy at Peking University (Beijing) with a M.A. in China Studies and Economics. He received my B.A. in History from the Higher School of Economics (Moscow).

Stop Tech exports from Western Europe to Russia

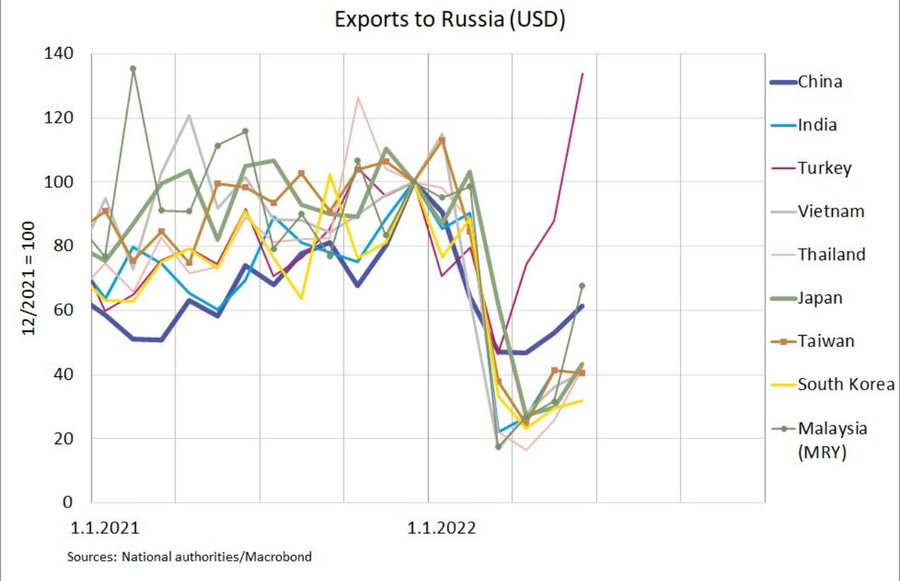

Analysts may be focusing too much on restricting the Russian fossil fuels export and too little on restricting the Russian import of: 1. industrial equipment 2. components necessary to keep the Putin's war machine going. Most of it is probably coming from Europe, not from China.

Russian import dynamics suggest that import from China has actually *decreased* since the start of the Special Operation. In other words, individual Chinese companies might have avoided doing business with Russia to avoid repercussions. Those that remained boosted the prices.

Meanwhile, the export from Turkey increased significantly. It is partially the Turkish production, including the foodstuff, etc. But much of it is probably the Western European technological export. In this case Turkey probably serves as a proxy and as a smuggling hub.

Most of European technological smuggling to Russia is organised in a shockingly simple way. Exporters typically use very "dumb" schemes with only one single proxy. Like Rheinmetall AG sells equipment to the Garnison Ltd to build Mulino, where Russian invasion army was trained.

Putin's military machine cannot do without European industrial equipment and components. Putin's rearmament was based on the direct technological import from the West. He tried to become more self-sufficient since 2011-2013, but failed. Import dependency is total.

Some critical dependencies of the Russian military industrial complex from Western Europe:

1) Machine tools. Most importantly, German. But also Italian, Swiss, Austrian, Czech

2) Metal cutting instruments. Especially Swedish - for precision manufacturing, like nuclear warheads

3) CNC. Even "Russian" or Belarusian produced machine tools operate with German/Japanese CNCs, software and Swedish instruments. Especially Siemens/Fanuc

4) Spindles, ballscrews, bearings, etc.

5) Cutting fluids (mostly Germany)

That's necessary to keep the Russian army going.

To stop Putin's military machine it's absolutely necessary to stop the technological import from Western Europe. Russian military plants cannot do without it. China can't substitute the loss of European suppliers.

Official European export to Russian has been growing in late-spring - early summer https://forbes.ru/biznes/474301-eksport-tovarov-iz-evrosouza-v-rossiu-vyros-v-iune-vtoroj-mesac-podrad… Unofficial grey schemes used to smuggle the forbidden equipment to Russia are usually very dumb and use one single proxy.

Track them.

Further reading

Rinat Tirov, Exports of goods from the European Union to Russia increased in June for the second month in a row-Forbes

Exports of goods from the EU to Russia in June amounted to almost €4.5 billion, up 18% from May. Deliveries under the sanctions increased for the second month in a row, but they are significantly less than they were a year ago. Exports of industrial equipment in June exceeded €1 billion, medicines came in second place.

In June, Germany was the largest exporter to Russia from the EU: delivered goods worth €1.16 billion, +5.4% compared to May. Italy is in second place: €532 million, +2.9%. Supplies from Poland increased by about 1.6 times (up to €395 million), and by a third from the Baltic countries (up to €481 million), RBC noted.

According to the results of June, imports of industrial equipment from the EU increased by 21% compared to May, its amount amounted to €1.12 billion. Compared to June last year, deliveries decreased by almost a third, but they exceeded the statistics of March or April 2022 twice . Exports from the EU to Russia of pumps, centrifuges, dishwashers, fire extinguishers, agricultural machinery, food and beverage preparation equipment, and lifting equipment (including elevators) have increased, RBC learned from Eurostat information. The second largest item of export from the EU to Russia in the context of trade nomenclature groups was medicines: in June they were delivered for €791 million. Supplies of perfumes and cosmetics increased by 38% in June, to €108 million.

The European Union has introduced several packages of various sanctions against Russia in response to its "special military operation" * in Ukraine. Sanctions restrictions on exports affected 28% of the cost of goods that were supplied to Russia before the start of the "military operation," RBC noted with reference to the European Commission. In mid-July, the European Commission clarified that EU sanctions in no way affect trade in agricultural products between Russia and third countries.

Part 2: The Danieli Group- still in Russia

In June, I called attention to the Danieli Group, which was still operating in Russia. As of the end of June, Danieli had not closed up shop.

I checked to see if the Danieli Group had closed its operations in its facilities in Nizhny Nogorod, Magnitogorsk, and Moscow, and they are still operational as per its website.

This is important because if we aren’t prepared to put ‘boots on the ground’ in Ukraine and fight alongside the Ukrainian forces against Russia’s dictatorship and criminal armed forces, then we should be cutting Russia off from access to what it needs to keep its war of genocide going.

This is what they manufacture:

Anton Shvets, How the Danieli company in Italy helps Putin to construct nuclear submarines and attacks Ukrainian volunteers

Danieli provides its services to the Viksun Metallurgical Plant, which manufactures pipes for Nord Stream II, and the Kamensk-Uralsky Metallurgical Works, which produces specific parts for Russian aircraft and is owned by a Russian tycoon Viktor Vekselberg. Let me remind you, he is under sanctions. It is not Danieli's only client with a sanctioned owner: Alexei Mordashov, Severstal's owner, is another.

According to Danieli Volga's website, the notorious "Magnitka" — Magnitogorsk Metallurgical Plant — is the Italian company's client. Its leadership is holding joint actions with the Union of Volunteers of Donbas – an organization of Russian mercenaries close to Wagner Group, which Russia has used in the war with Ukraine since 2014. Now it is used for covert mobilization in the Russian army.

On April 13, the limited company "Corporatsiya "Krasnyi Oktyabr" in an official press release, expressed its gratitude to Danieli for the continued cooperation. Moreover, in the nearest future, "Krasnyi Oktyabr" will receive another machine tool from Danieli.

Limited company "Corporatsiya "Krasnyi Oktyabr’" is one of the largest Russian special steel producers. For instance, it manufactures pressure vessels for nuclear reactors of Russian submarines and protection for the cutting-edge T-14 "Armata" Russian tanks.

Let me repeat. Danieli confirmed the continuation of relations with a company involved in the production of tanks and submarines and did that in the background of the Bucha massacre and siege of Mariupol.

Italian-Russian business: disproportionate influence

In February 2022, there were 500 Italian companies operating in or exporting to Russia in the energy, steel, gas & oil, chemical, aeronautics, transportation, advanced technology, agriculture, finance industries, and luxury goods.

CEOs from 16 industrial companies had a videoconference call with Putin on February 27 to talk about Italy’s commercial interests in Russia and what was to be done. There were representatives from Pirelli, Enel, Orcel, Generali Insurance all of which have long-standing partnerships with Moscow. They also talked about the 60 Italian companies that are directly involved in Russia’s energy projects: Yamal LNG, Arctic LNG and Vostok Oil.

Last year Italy exported 7 billion euro worth of goods and services to Russia and imported 12.6 bilion euro from Russia. Russia’s cut of Italian import-export business amounts to a total of 3%, down from 5.2% in 2014. To put this into perspective, Italy exported roughly 29 billion euro worth of goods and services to European Union countries last year, and that’s down 1 billion euro from 2020.

The focus of this post was the Danieli Group, but Italian industry, especially in the Veneto, Emilia Romagna and Lombardy regions, are still tied to Russia, so much so that the Verona Eurasian Economic Forum is on its way to Baku, Azerbaijan. Italian business interests will be meeting with business leaders from Turkmenistan, 1200 km from Moscow. Who will be in attendance and why change location after so many years?

One look at the programme for this year and you can pretty much figure that one out for yourself:

SPECIAL SESSION (WITH THE SUPPORT OF ROSNEFT): THE NEW REALITY OF COMMODITY AND ENERGY MARKETS

Global commodities and energy markets clearly mirror the rapid geopolitical changes taking place around the world. What used to take years and even decades is happening before our eyes, literally in real-time. What is the new reality emerging from these processes? What will these markets look like in the long term? The speakers will offer answers to these and other pressing questions.

Last year’s forum was partnered by Intesa Sanpaolo, Rosneft, Gazprombank, VTB Bank, Region Investment Company, Credit Bank of Moscow, LEX Systems and sponsored by Banca Intesa, Accenture, Coeclerici, Assicurazioni Generali. Speakers included Gerhard Schroeder, Antonio Fallico, Igor Sechin, Ambassador Razov, Sergey Karaganov, Sanal Ushanov and Viktor Vekselberg to name but a few. This is the creme della creme of Italian industrial leaders and Russian oligarchs.

The volume of business between Italy and Russia cannot justify Russia’s disproportionate influence over Italian politicians on the right and the left. What the data does say is that there is a small group of Italian industrial businessmen and women who have traditionally had weight within the most prominent Italian political parties: Salvini’s League, Berlusconi’s Forza Italia and the Democratic Party.

It’s extemely difficult to find out to what extent the Verona Eurasia Forum or Italian business leaders with tight relationships with Russian oligarchs influence Italian domestic and foreign policy. Italy does not have laws to regulate lobbying, nor does it have transparency laws that could shed light on donations to the personal foundations politicians and business people.

They are desperately needed if Italy is to fight corruption, illicite financial practices, and influence operations. The current political leadership has no will to discuss this, let alone draft legislation. In this electoral cycle, not one party on the left, the centre, or the right has included these reforms in their party platforms.

If it’s not possible to understand how Russian interests impact Italian domestic and foreign policy, we can look elsewhere: what Draghi’s government did achieve in seventeen months:

We are overcoming the pandemic; on the international front, Italy has rightfully regained an important role: we are supporting Ukraine and working towards peace; with regard to the economy, we recorded a 6.6% growth in GDP last year. We are now recording a slowdown, due to the war. The Government’s task is to support workers and businesses and to make Italy more modern, more liveable, more just.

There’s more. The Draghi government passed 125 laws, and began to address Italy’s security threats by sending a record 30 Russian embassy personnel back to Moscow, and providing more funds and staff for Italy’s nascent cyber intelligence unit. Most importantly, Draghi managed to de-Russify Italian energy supplies.

Giuseppe Conte, Matteo Salvini and Silvio Berlusconi (egged on by Giorgia Meloni) pulled the plug on the Draghi government when only 19% of the Italian population wanted a change of leadership. There was absolutely no reason not to get to the natural end of the legislature, especially because there was so much work left to do.

With the radical-right, traditionally pro-Kremlin coalition set to win the next Italian general election on September 25, there is no hope in hell that Italy wil continue its robust support for Ukraine, and the Atlantic partnership. Italy will keep one foot in the Russian camp and a toe within the Western alliance as it has done for so many years.

Benjamin and Kamil should look elsewhere within western Europe for support on stopping high tech exports to Russia, and its criminal war machine.

Part 3: Yale University School of Management, Over 1,000 Companies Have Curtailed Operations in Russia—But Some Remain

If you’re interested in finding out which companies from your country are still operating in Russia, please view the Yale University School of Management page here.

Since the invasion of Ukraine began, we have been tracking the responses of well over 1,200 companies, and counting. Over 1,000 companies have publicly announced they are voluntarily curtailing operations in Russia to some degree beyond the bare minimum legally required by international sanctions — but some companies have continued to operate in Russia undeterred.

Originally a simple "withdraw" vs. "remain" list, our list of companies now consists of five categories—graded on a school-style letter grade scale of A-F for the completeness of withdrawal.